House Health Plan Chart July 23, 2009

Posted by Austin Baker in employee benefits, Health Care Legislation.Tags: Health Care Chart House Plans, Health Insurance, health insurance costs

add a comment

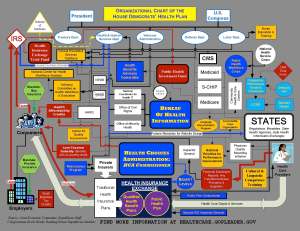

House health Plan Chart- Are you trying to Understand How the system would work- Check out this Chart!

Senators outline options for public insurance plan 5/12/09 — www.GovernmentExecutive.com May 13, 2009

Posted by Austin Baker in employee benefits.add a comment

COBRA Subsidy Update – ARRA of 2009 March 13, 2009

Posted by Austin Baker in COBRA, employee benefits.Tags: ARRA, COBRA, Subsidy

2 comments

Are you ready? Effective March 1st Uncle Sam will now pay 65% of COBRA Premiums. You have until April 17th to issue new COBRA notices to all your employees and employees involuntarily terminated all the way back to September 2008. This also applies to small business owners with 2-19 employees in specific states with ‘mini COBRA” laws.

The Facts

The duration of COBRA subsidized coverage will pay a maximum of 9 months subsidy for COBRA coverage. Subsidy ends sooner if individual becomes eligible for coverage under another group health plan or Medicare. Total of 18 months of COBRA coverage is available in most cases, consistent with current law.

The amount of subsidy follows the following format. Individuals pay 35% of COBRA premium and 65% of premium

is subsidized by employer (which the employer may then claim as a credit against wage withholdings and payroll taxes). The subsidy phases out for taxpayers with modified adjusted gross income exceeding $145,000 (or $290,000 for joint filers) and is reduced proportionately for taxpayers with adjusted gross income between $125,000 and $145,000 ($250,000 and $290,000 for joint filers).

There is a special election period? There is 60-day special election required for those eligible for the subsidy if they had not previously elected COBRA. Special election opportunity also applies to a qualified beneficiary who elected

COBRA coverage but who is no longer enrolled on the date of enactment.

Employees may have the option to change coverage to different plan offered by an employer. At the employer’s option, eligible individuals may be allowed to apply the COBRA subsidy to any health plan option offered by their employer to active employees, provided that the coverage has the same or lower premium as the individual’s continuation

coverage.

Employers may claim a tax credit against periodic deposits for wage withholdings and FICA payroll taxes for the portion of COBRA premium not paid by individual. If the employer’sclaims for COBRA subsidy payments exceed the amount of wagewithholdings or FICA payroll taxes reported by the employer,Treasury is directed to reimburse the employer directly for theexcess amount. Entities entitled to reimbursement must reportcertain information to the Treasury Department, includingattestations of involuntary termination for each coveredemployee and amounts of payroll taxes offset for the reportingperiod and estimated offsets for the subsequent reporting period.

Action Steps

1. Identify individuals eligible for COBRA who were terminated on an involuntary basis on or after September 1, 2008 and dependents of these individuals who previously became eligible for COBRA.

2. Revise and update COBRA communications materials, placing a priority on creating a notice for those terminated employees immediately entitled to a new COBRA enrollment period.

3. Notify all individuals within 60 days of the bill’s enactment of their new COBRA election period and of the availability of the premium subsidy (and, if applicable, other COBRA coverage options).

4. Coordinate with payroll to revise systems and other procedures for paying the government’s 65% share of the COBRA premium and for reflecting the revised charges on premium statements sent to participants.

5. Coordinate with payroll and systems personnel to revise systems and other procedures for obtaining reimbursement of these amounts from the federal government.

6. Coordinate with payroll and systems personnel to revise systems and other procedures for determining participant premium over payments and crediting the payments to future premiums or returning the over payments directly to the participant.

7. Develop processes, procedures, and systems changes necessary to end the subsidy when the individual no longer is able to claim it and to reinstate the 100% COBRA premium charge if the individual continues to be eligible for COBRA after termination of the subsidy.

8. Determine whether the employer wishes to allow the former employee to switch to alternative health coverage for COBRA purposes.

9. If the employer currently pays for some portion of COBRA premiums, determine whether these payments should be restructured.

10. If significant reductions in force have been made since September 1 or may be made in the near future, determine how these new rules will affect COBRA claims experience and administrative costs for self-funded plans. If necessary, perform the actuarial calculations necessary to revise future plan rates.

11. Revise and update employee data capture procedures to update addresses on employees and dependents that could be eligible.

Helpful Websites

http://www.dol.gov/ebsa/cobra.html

http://www.irs.gov/newsroom/article/0,,id=204505,00.html

For Assistance with your Plan Please Contact- Find out how we can help keep you in Compliance!

Austin Baker

President EServ, LLC.

901-737-1023

austinb@eservbenefits.com

Sources: SHRM, AON, American Benefits Council, DOL, IRS

Small Businesses are affected by the new COBRA Subsidy March 13, 2009

Posted by Austin Baker in employee benefits.Tags: COBRA, compliance

add a comment

The clock has struck midnight. The subsidy is available starting March 1st, yet many business owners do not understand that this new COBRA subsidy legislation may affect them regardless of their size. For business owners with more than 20 FTE employees (Part time Count as 1/2) you are subject to COBRA. Employers with 2-19 lives, you may be subject to “mini-COBRA” state laws sometimes known as state continuation of coverage. Please see the listing below. If so you need to immediately recalculate any payments being made by employees and reconcile any possible credits that should be offered.

Now more than ever it is important that you are prepared to notify benefit eligible employees currently in your organization and everyone that has any termination going back to September. For ‘mini-COBRA” the window might vary based on the length of time required by the state. Why do I say everyone with any instead of the “involuntary termination” rule that is in the act? Every employer has a one shot window to notify all employees going back to Sept. 08′. Would it not be better to notify everyone that they “could” be eligible and then deal with the gross misconduct terminations as they may come back to you with requests.

State Listings:

These laws are subject to change and the details on this page may not be current.

Arkansas: Act 997 of 1997 requires employers with 2-19 employees to offer COBRA for 4 months.

California: Cal-COBRA applies to employers with 2-19 employees and provides these employees 36 months of coverage.

Colorado: 2 employees in Colorado as of Jan 1, 1998, can get COBRA. if you are declined for coverage because of pre-existing conditions, you will be eligible for the Colorado Uninsurable Health Insurance Plan, called CUHIP. This is a state-run program for people in this situation.

Connecticut: Public Act 97-268 gives disabled individuals continuation benefits for 29 months, instead of the 36 months. Also, employees of any employer group policy to be offered COBRA for 24 months.

Florida: The Florida Health Insurance Coverage Continuation Act requires insurance companies to offer an 18-month continuation for groups of 2-19, but the employee has only 30 days to request this extension.

Georgia: Requires employers with 2-19 employees to offer COBRA for 3 months.

Illinois: The Illinois Continuation Law provides employees of any employer group policy to be offered COBRA for 18 months.

Iowa: Chapter 509B and Regulation 29 provide for continuation and conversion of group insurance. Employer plans of from 2-19 participants can qualify for 9 months

Kansas: Kansas Continuation law requires employers with 2-19 employees to offer COBRA for 6 months.

Kentucky: Chapter 304 of the Kansas Insurance Code provides employees of any employer group policy to be offered COBRA for 18 months.

Louisiana: Regulation 68 requires employers with 2-19 employees to offer COBRA for 12 months.

Maine: Requires employers with 2-19 employees to offer COBRA for 12 months.

Maryland: Maryland Continuation law provides employees of any employer group policy to be offered COBRA for 18 months.

Massachusetts: Massachusetts Mini-COBRA law requires employers with 2-19 employees to offer COBRA for 18 months.

Minnesota: Code 62 requires employers with 2-19 employees to offer COBRA for 18 months.

Mississippi: requires employers with 2-19 employees to offer COBRA for 12 months.

Missouri: Statute Chapter 376, Section 376.428 requires employers with less than 20 employees to offer COBRA for 9 months.

Nebraska: Offers a Comprehensive Health Insurance Pool for the uninsurable.

Nevada: Chapter 689B requires employers with 2-19 employees to offer COBRA for 18 months.

New Hampshire: State Bulletin 711, RE: Chapter 29 laws of 1994 requires employers with 2-19 employees to offer COBRA for 18 months.

New Jersey: Plans with 2-19 employees can qualify for 12 months of COBRA continuation coverage.

New Mexico: title 13, Chapter 10, Part 11.31 states that plans with 2-19 employees can qualify for 6 months of continuation coverage.

New York: Guaranteed Issue state law that requires insurers to cover anyone who applies. For more information visit this source: Source: http://www.ins.state.ny.us/faqcs1.htm#cobra

North Carolina: North Carolina State Continuation laws state that plans with 2-19 employees can qualify for 18 months.

North Dakota: If your employer has less than 20 employees, you will fall under North Dakota state law. This law identifies the specific rules and regulations to continue your group health coverage. Like COBRA, coverage is only temporary — 39 weeks.

Ohio: Section 3923.38 of the Ohio Revised Code states plans with 10-19 employees can qualify for continuation coverage.

Oklahoma: Oklahoma Statute title 36, Chapter 1, Article 45 states that plans with 2-19 employees can qualify for 1 month of guaranteed continuation.

Oregon: State continuation of coverage. You may be eligible to continue your group policy if your benefits are affected by termination from employment, dissolution of marriage or legal

separation, or you are a surviving spouse and you do not qualify for COBRA coverage. Your former employer must have 19 or fewer employees. A continuation-of-coverage policy will provide protection for a maximum of six months or until you are eligible for other coverage (including Medicare) whichever is shorter. The coverage may or may not include optional benefits such as vision, dental, or prescription coverage. Source: Oregon Consumer Guide to Health Insurance

Rhode Island: Chapter 27-20.4 Insurance Continuation Act states plans with 2-19 employees can qualify for 18 months of continued coverage.

South Carolina: Employees of employers with 2-19 employees can qualify for 6 months of continuation coverage.

South Dakota: Employees of employers with 2-19 employees can qualify for 18 months of continuation coverage.

Tennessee: Employees of employers with 2-19 employees can qualify for 3 months of continuation coverage.

Texas: Employees of employers with 2-19 employees can qualify for 6 months of continuation coverage. http://www.tdi.state.tx.us/consumer/cbo05.htm

Utah: Utah Code – title 31A, Chapter 30 states employees of employers with 2-19 employees can qualify for 6 months of continuation coverage.

Vermont: Employees of employers with 2-19 employees can qualify for 6 months of continuation coverage. http://www.bishca.state.vt.us/Regs&Bulls/insbulls/BUL78.htm

West Virginia: Employees of employers with 2-19 employees can qualify for 18 months of continuation coverage.

Wisconsin: Employees of employers with 2-19 employees can qualify for 18 months of continuation coverage.

Wyoming: Employees of employers with 2-19 employees can qualify for 18 months of continuation coverage.

I am not a practicing lawyer, so do not take this blog as legal advice. However if you need assistance please call or email and I can help guide you through the adminstration process and provide consultative services to find the right vendor and button down your current processes to maintain compliance.

Keys to Successful Implementation of Consumer-Driven Benefits January 12, 2009

Posted by Austin Baker in Consumer Driven Benefits, employee benefits.Tags: Benefit Communication, Consumer Drive Benefiits, Consumer Driven Benefits, voluntary benefits

1 comment so far

Employers everywhere are feeling the pinch of double-digit health insurance inflation. One trend that more employers are adopting as a possible solution is the consumer-driven benefits approach, which typically couples a high-deductible health plan with a personal health account, such as a health savings account (HSA) or and employer sponsored health reimbursement arrangement (HRA). The thinking behind this approach is that employees may be more careful about managing health care expenses when they’re footing a larger portion of the bill. To successfully implement the consumer-driven benefits approach with your employees, there are two critical factors that must be part of your implementation plan:

Voluntary Benefits Bring Employees Choice

With the move toward high-deductible health plans, your role is changing from providing and paying for traditional benefits to providing access to a wide variety of quality benefits — both core and voluntary. This way, you can maintain a competitive benefits package and still provide employees with options to lessen the effects of their increased financial risk for medical expenses:

1. Provide choices in health plans. Many employers are offering a menu of two or more health plans ranging from full coverage plans with higher premiums to high-deductible plans with lower premiums. Employees can then select health coverage that makes sense for their own situation.

2. Use voluntary benefits to expand benefits program choices. Voluntary benefits can enhance and expand your benefits program without additional budget constraints. You can offer a wide variety of individual and group voluntary insurance products from life to disability and supplemental health coverage, and you can fund some of the costs or let employees pay the premiums. Employees can then choose products they need to fill any coverage gaps.

3. Voluntary benefits fill in the gaps and reduce cost. A well designed voluntary benefits program can provide first dollar coverage. An HRA that has an up-front deductible will cost and employer significantly less. These savings can be used to partially fund a portable first dollar hospital indemnity plan. If you are using an HSA it may take a year or two to properly fund the accounts in order to provide the necessary cushion that an employee needs to take responsibility for his or her up-front health care expenses. An HSA compliant hospital indemnity plan gives an employee the breathing room that they need to learn how the new health plan will work.

Effective Benefits Communications Is Essential

With the consumer-driven benefits approach, if you don’t effectively communicate benefits, employees perceive the approach as mere cost-shifting. That’s why effective benefits communication is vital. A voluntary benefits partner can bring you not only product solutions but also benefits communications solutions, such as one-on-one employee sessions that cover core benefits in addition to voluntary benefits. When done well, benefits communications can help employees learn about their benefits and learn about the value of what their employer provides.

According to the Watson Wyatt WorkUSA 2004 study, “how well a company communicates the value of its health benefits can do more to retain top-performing employees than the actual richness of the benefits themselves.” In companies that don’t do a good job communicating the value of their rich benefits programs, only 22 percent of surveyed employees were satisfied with their benefits package. Conversely, in organizations that do a comprehensive job communicating the value of less rich benefit packages, 76 percent of employees were satisfied with their benefits.

Find a quality voluntary benefits provider who can help you successfully implement the consumer-driven benefits approach by bringing voluntary coverage choices and effective benefits communications capabilities. You can benefit through better management of your benefits program budget, an enhanced benefits program and improved attraction and retention rates for quality employees. Employees can benefit by having a variety of coverage choices to meet their needs and by getting help to understand their benefits and the value of them.

Voluntary Short-Term Disability Insurance Needed Now More than Ever January 5, 2009

Posted by Austin Baker in employee benefits.Tags: Benefit Communication, benefits counseling, colonial life, Disability Insurance, employee benefits, Short Term Disability Insurance, voluntary benefits

add a comment

Now more than ever as American’s are watching their pocketbooks more closely is the time to consider what would happen if no income were flowing into your pocketbook. Many employees are considering the effects of being laid off, yet ignoring the reality that a more devastating and unexpected financial blow could come first. Many American workers don’t realize how an injury or illness can put their lifestyles, assets and even their children’s education at risk. Although health insurance may cover a majority of medical expenses that occur during a short-term disability, if an employee can’t earn a paycheck for a few weeks or months, how will he or she pay the mortgage, buy groceries or pay the heating bills?

You may think that long-term disability insurance is all the coverage employees need; however, there’s also a big need to provide employees with paycheck coverage if they have a short-term disability. With many companies cutting back on paid time-off and sick leave, employees who are disabled and can’t work for a short time can experience a coverage gap between when sick leave ends and when they qualify for long-term disability benefits. Having a voluntary short-term disability plan is one way employees can help insure their paycheck.

Features to Look for in a Good Voluntary Short-Term Disability Product

Paycheck insurance is important, but the top products offer even more. Here’s what you should look for when you’re shopping for a good voluntary short-term disability product:

Guaranteed Issue: With guaranteed issue, you can offer your short-term disability coverage with no health underwriting as long as minimum participation and eligibility guidelines are met.

Portability: Employees can keep the policy if they change jobs.

Partial Disability Benefits: Voluntary short-term disability products should provide partial disability benefits when employees who are totally disabled come back to work earlier. Employers and employees like this feature because employees can ease back in to work and still receive a partial disability benefit.

Definition of “Your Job”: Some new voluntary short-term disability products define total disability in terms of “your job” for the entire benefit period. Benefits pay when the employee isn’t able to perform his or her own occupation. Other products may not pay “your job” benefits or may only pay under an “any job” benefits definition.

A Variety of Elimination and Benefit Periods. Lastly, you need to be sure that the voluntary short-term disability product you offer fits with the employer’s benefit program. The benefit period should complement any group long-term disability plan your client provides. Find a short-term disability product with a variety of elimination periods that will work with any paid-time off or sick leave program a client may have. For example, if a client provides four weeks of paid time off, it doesn’t make sense to recommend a voluntary short-term disability product that starts paying benefits after two weeks of disability.

Comprehensive Benefits Communication: Effective benefits communication plays a key part in helping answer employees’ benefits questions so they can make better benefits decisions. Employees need to understand their whole benefits package, especially where they may have coverage gaps and particularly in the area of disability coverage. Many employees think their sick leave will cover them until their long-term disability kicks in; however, that’s not always the case, and employees need to be aware of any disability coverage gaps. You may want to partner with an experienced worksite marketing benefits professional who can provide comprehensive benefits communications for you and your employees at no cost.

Help your employees protect their most valuable asset—their income. Add a strong voluntary short-term disability product to your employee benefit program.

Rising Health Care Costs Put Pressure on Small Businesses December 24, 2008

Posted by Austin Baker in employee benefits.Tags: health care, Health Insurance, health insurance costs, Small Business, voluntary benefits

add a comment

Although double-digit health insurance cost increases affect all business owners no matter the size of their company, smaller businesses feel more pressure because they typically don’t have as many benefits options available to them as large companies. Yet you need to offer a competitive benefits package to compete with larger companies for qualified employees.

Voluntary benefits offered at the worksite can help small businesses lessen benefits program management pressures by providing much-needed solutions: voluntary products to help employees fill gaps in their core benefits and benefits communications to help employees better understand their benefits and the value of what you provide them.

Voluntary Products Expand the Benefits Program

We’re seeing larger numbers of small business employers putting in high deductible health plans, and some are even adopting consumer-driven health care plans. Either way, employees are taking on more responsibility for their health care expenses. Voluntary benefits can help you better manage your benefits program costs and help provide employees with coverage choices to meet their out-of-pocket medical expenses. Adding a supplemental health insurance product and other voluntary benefits such as life insurance, cancer insurance and short-term disability can expand your benefits program. For example, if you have a high-deductible health plan, employees could choose a supplemental health insurance product to help pay for their additional out-of-pocket expenses.

With voluntary benefits, you can pay a portion or all of the premiums for the voluntary benefits or let employees pay for the additional benefits themselves.

Benefits Communications Helps Employees Understand and Appreciate Their Benefits

Small businesses typically have little to no human resources staff, which means the business owner often handles HR duties in addition to all the other responsibilities. In many cases, you don’t have the time and resources to fully communicate your benefits program. Yet employees who understand the benefits they have and the value of what their employer provides appreciate their company more and use their benefits more responsibly, according to the Watson Wyatt WorkUSA 2004 study.

Having a voluntary benefits partner who can communicate your benefits program — both core and voluntary benefits — and help employees make educated coverage decisions can help take the load off of you. Find a voluntary benefits partner who’s experienced in conducting one-on-one benefits communication sessions and who’s willing to provide this valuable service at no cost. Many larger companies have staff or outside partners to help them with benefits communications and enrollments. But by partnering with a quality voluntary benefits provider, you can take advantage of these services in your own company at no additional expense. It’s a huge competitive advantage.

Voluntary benefits can help you relieve some of the pressure from increasing health insurance costs yet still remain competitive in the marketplace. The benefit to you is an enhanced benefits program, savings in program costs, quality benefits communications and an effective enrollment process. Your employees will benefit from having more coverage choices to meet their needs, plus they’ll understand and appreciate the value of what you provide for them.

Effective Benefits Communications Saves Your Company Money, Time and Energy December 24, 2008

Posted by Austin Baker in employee benefits.Tags: Benefit Communication, employee benefits, Enrollment, Health Insurance

add a comment

As health care costs continue to rise, it’s more important than ever that your employees understand and appreciate the benefits you provide for them. Along with increasing health insurance costs comes increasing competition for quality employees, and you want to attract and retain the best. In fact, the average turnover rate of top-performing employees is 17 percent at companies that offer rich benefits programs but poorly communicate them to workers, as opposed to 12 percent at businesses with less comprehensive programs but better communication strategies.

A sound benefits package is a plus but only if employees know and understand what you make available to them. A quality voluntary benefits partner can help by providing professional, consistent communications throughout the entire enrollment process. As a result, employees will not only understand their benefits but also appreciate them.

Effective benefits communications has two integral phases: before the enrollment and during the enrollment. For each phase, your voluntary benefits partner should be able to deliver a wide range of services and capabilities.

Pre-Enrollment Communications

Custom Communications. A quality voluntary benefits provider can provide enrollment communications such as letters, fliers, PowerPoint presentations, brochures, e-mails, posters, tent cards — whatever works best to help employees learn the about the upcoming enrollment and the key details of the benefits offerings.

Group Meetings. To help provide background on the overall benefits program, highlight any major changes in the program and introduce any new offerings, the enrollment process should begin with a group employee meeting that covers key highlights of the benefits program.

Enrollment Communications Through One-on-One Sessions With a Benefits Professional

Advances in enrollment technology have made enrollments simpler and easier to administer; however, nothing can replace the value of having a trained benefits professional meet with employees individually to review and enroll their benefits. Two-way communications between a benefits professional and an employee is critical for effective benefits communications.

Using the latest enrollment technology, a benefits professional can help employees consider their personal benefits situation and see the impact of their benefits selections on their paycheck. Communication services can include:

• Helping employees verify and update basic employee data.

• Highlighting each employee’s existing benefits, pointing out what the employee contributes and what the employer contributes.

• Reviewing the employee’s benefits selections and how each affects the paycheck so the employee can see exactly what the deductions will be and, if pretaxing, what the savings can be.

• Showing the employee his or her entire benefits package, including paid time off, uniform costs or any specific benefits you want to highlight. Again, the employee can see his or her own contributions to the benefits package, as well as what you contribute.

• Providing a detailed listing of the employee’s selections and contributions as one last verification of plan information and premiums.

So what’s the advantage of effective benefits communication? You’ll save costs, time and energy — plus, you’ll gain greater employee satisfaction through personal, quality benefits communication.

1 2005 Watson Wyatt Worldwide WorkUSA® study on effective employee-driven financial results

Benefits Solutions to Health Insurance Dilemma December 24, 2008

Posted by Austin Baker in employee benefits.Tags: access to care, austin baker, colonial life, deductibles, employee benefits, gap plans, Health Insurance, limited benefit medical plans, Mini-med plans

add a comment

Rapidly rising health care costs and the plight of the uninsured have reached the status of nearly daily mention in most news media. As health care costs continue to increase, many businesses are moving toward high-deductible major medical plans in an effort to better manage benefits program costs. Yet this approach can put employees at greater financial risk, forcing them to pay the expanding difference between what their health insurance covers and what their medical care costs. In addition, premiums for employer-sponsored health insurance have been rising four times faster on average than workers’ earnings since 2000.1

While that’s bad enough news for workers with health insurance, it’s a potential disaster for those who don’t have health coverage to help buffer these costs. A recent Census Bureau report estimated 47 million Americans have no health coverage.2 Still more worrisome is the fact that most uninsureds belong to a family with at least one working member. 3

The good news is employers have access to two solutions to meet this health coverage dilemma:

A voluntary supplemental health insurance plan can help fill gaps in coverage under a high-deductible major medical plan, such as increased deductibles and out-of-pocket maximums.

A group limited benefit hospital confinement indemnity insurance plan for employees who don’t have access to major medical insurance through their workplace or their spouse’s workplace.

Voluntary Supplemental Health Insurance

With voluntary supplemental health insurance, businesses can offer their employees a solution to help fill coverage gaps and protect employees against increasing out-of-pocket expenses. These products typically pay lump-sum benefits for medical expenses resulting from inpatient hospitalization and rehabilitation unit or outpatient services, diagnostic testing, doctor’s office visits and wellness checkups. For example, an employee who has to go into the hospital may have to pay a $1,500 deductible before health insurance kicks in — money the employee has to pay up front. With voluntary supplemental health insurance, the employee would receive a lump-sum benefit payment for the inpatient confinement and could use it to help pay for the deductible.

Group Limited Benefit Hospital Confinement Indemnity Insurance

This type of insurance is a group product that provides benefits to help insureds pay many routine, noncatastrophic health care expenses. It’s not major medical coverage, and it isn’t a replacement for major medical coverage. Offered through the workplace at group rates, this plan can meet the need for affordable, limited and clearly defined health benefits for full-time and part-time workers who don’t have access to major medical insurance and need some coverage for basic, routine medical expenses. Coverage is available for:

• Doctor’s office visits

• Outpatient diagnostic and lab tests

• Inpatient hospital stays

• Surgery

• Prescription drugs

With either plan, benefits communication plays a critical role in successful implementation. Consistent, clear communication through group and one-on-one meetings with employees helps ensure they understand what their plan covers and what it doesn’t. This leads to much greater satisfaction with the benefits plan. A quality voluntary benefits provider can deliver this service at no direct charge to the employer.

Rising health care costs and the resulting plight of the working uninsured are not likely to go away anytime soon. But innovative products like voluntary supplemental health insurance and group limited benefit hospital confinement indemnity insurance provide workable solutions for the health care cost issue.